Ot calculator with tax

Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. Target Heart Rate Calculator.

Solved W2 Box 1 Not Calculating Correctly

If you dont yet have the employees W-4 the calculator can fill in tax rates to help you create a semi-accurate paycheck estimate.

. If you have questions about your tax liability or concerns about compliance please consult your qualified legal tax or accounting professional. ATV Purchase Price - The price that you will pay for your ATV. Section 80D of Income Tax Act says that the insured can claim for tax deduction against the premium paid for health insurance.

OT Dude does not make any warranty or guarantees with respect to the accuracy applicability or completeness of accessible. Estimate your total cost of ownership and cost savings. Click on the link below to learn how to easily create a drop-down list.

Everything You Need to File Your Taxes. Tracking weakness in the US market Information Technology IT stocks fell the most on the benchmarks on WednesdayThe Nifty IT index declined almost four percent led by a big drop in share price of tech stocks such as Tata Consultancy Services TCS Infosys Tech Mahindra and HCL Tech. Federal law- 40 hours for OT Some states have OT laws If an employee is subject to federal and state laws the law paying the higher amount of OT is followed.

Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. Compute your best workout. Monthly Payment - The monthly payment that is calculated based on the data you enter in the 3 fields above.

The state will ask you to enter your adjusted gross income AGI. Fill in the employees state tax. I Endured a Tech Layoff Twice.

My wife and I were approaching our wedding day when I got the. Manage multiple tax accounts from one login Apply for lice nses including Retail and ABL File tax returns and reduce errors with automatic calculations Make and schedule payments View copies of notices letters and other correspondence from SCDOR. 12 The chained-dollar value is derived by updating a base-period dollar value amount by the change in the GDP quantity index which in turn is derived with the use of a Fisher ideal index formula that aggregates from component GDP quantity indexes.

The calculator wont accurately project payments for an adjustable rate loan. An individual can claim a deduction of up to Rs. Calculator² is the beautifully designed all-in-one calculator app for students and professionals.

Learn how to manage and optimize your cloud spend. TCS Infosys Wipro Tech Mahindra HCL Tech share target price. Sample Income Tax Computations under TRAIN 2023 Onwards Take note that part 2 of the TRAIN tax rates will take effect beginning year 2023.

Heres How I Created 11 Income Streams and Bulletproofed My Finances. Select A Hope Lodge. The results are broken down into yearly monthly weekly daily and hourly wages.

Total OT shows the total amount of Overtime earned by the employee. You can find this by signing in to TurboTax and scrolling down to Your tax returns documentsSelect 2021 then View adjusted gross income AGI in the right column. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to.

Estimate the costs for Azure products and services. How to create a drop-down list in 3 easy steps. The refund date youll see doesnt include the.

The currency converter with exchange rates updated in real-time and unit converter offer 150 World. You can track it at the Michigan Department of Treasury Wheres My Refund. The advanced scientific financial and programmer calculators provide a comprehensive set of mathematical functions and constants to help you perform any type of calculation.

Determining between CGA vs SBA. Enter the rate per hour for overtime. The American Cancer Society is a qualified 501c3 tax-exempt organization.

25000 on health insurance premium. Please note that this ATV loan calculator is for loans with a fixed interest rate. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

The GDP implicit price deflator deflates the current nominal-dollar value of GDP by the chained-dollar value of GDP. Assessment Tools One way to determine that your client is CGA or SBA is based on their fall risk from a fall scale such as the Morse Fall Scale. This cell will display the total number of hours worked by the employee for the whole month.

2021-2022 Tax Brackets and Federal Income Tax Rates By Ellen Chang Contributor Tax Prep Checklist. The formula to follow though is still the same. Paying P190000 income tax on taxable income of P1 Million the taxpayer is therefore charged an effective income tax rate of 19.

OT Dude does not offer a substitute for professional legal or tax advice. Commonwealth Bank is also not a registered tax financial adviser under the Tax Agent Services Act 2009 and you should seek tax advice from a registered tax agent or a registered tax financial adviser if you intend to rely on this information to satisfy the liabilities or obligations or claim entitlements that arise or could arise under a. A high fall risk client would likely need at least CGA if not SBA but unlikely be supervised or independent.

Evaluation when evaluating a client for the first time a therapist can determine.

Overtime Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate Gross Income Per Month

Payroll Calculator With Pay Stubs For Excel

How To Calculate Payroll Taxes Methods Examples More

Overtime Calculator

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

Salary Overtime Calculator Calculate Time And A Half Double Time Wages

Check Your Paycheck News Congressman Daniel Webster

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

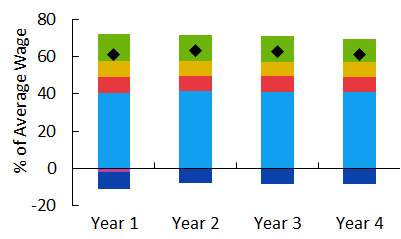

Tax Benefit Web Calculator Oecd

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Paycheck Calculator Take Home Pay Calculator

New York Hourly Paycheck Calculator Gusto

Salary Overtime Calculator Calculate Time And A Half Double Time Wages