Calculating margin from cost and selling price

If you are calculating the markup the selling price will. For example 001 equals 1 01 equals 10 percent and 10 equals 100 percent.

How Can I Calculate Break Even Analysis In Excel Analysis Excel Graphing

The final cost reduction example is slightly more complex.

. It has sold 50000 units of its products. With a markup percentage of 50 you should sell your socks at a 250 markup or a total price of. Before we dive into pour cost formulas lets get on the same page regarding liquor costs in general.

Gross profit margin shows how efficiently a company is running. In calculating actual or landed cost all expenses incurred in acquiring an item are added to the cost of items in order to. The project value is now.

113780 85335 28445 savings per year. In formula form this looks like this. The reason your liquor cost percentage is so important is because it is a factor that determines your profits.

Any change in price directly impacts Profit margin. The cost price for each bread machine is 150 and the business hopes to earn a 40 profit margin. From the data available you can easily calculate the selling price per unit of each fruit Amount of Sales for each fruit sold divided by the number of units sold.

From the above calculation for the gross margin we can say that the gross margin of Honey Chocolate Ltd. Lets deal with Price variance first. Expense net sales yields a percentage that when used as the target margin will produce gross profit.

For example if we have a product with a unit cost of 1 Euro and we apply a percentage on cost of 50 the calculated sale price would be 15 Euros however the margin or profit of this sale price with respect to its cost would be only 333 and not 50. Calculate gross margin on a product cost and selling price including profit margin and mark up percentage. The margin of Safety when total revenue is required margin of safety units selling priceunit.

Now its time to plug the numbers into the selling price formula. Therefore the contribution margin per unit will be 20 5 15. Assuming that quality has slipped a bit since the company increased its output to 528 units per year they are now considering an improvement project to reduce returned products by 25 percent.

Using the same cost 500 and selling price 1000 as above the markup would be 100 because you are marking up the cost of the product by 100. In our example the gross profit margin is 100 divided by 100 so we get a profit margin percentage of 100 percent. Calculation of sales prices on a percentage of the cost.

5 x 50 250 5 725 New Selling Price. Subtract the cost of the voucher from the price received from its sale. The variable cost per unit is 2 per unit.

Good Company has net sales of 300000. So for example for Apples the selling price for 2018 is 11 660 Sales 60 units sold. A markup is an extra amount that a retailer adds to the cost of production when determining the customer-facing price of a product or service.

Profit selling price excluding tax when expressed as a percentage produces gross profit or GP. These formulas are implemented based on the given conditions. If you know at least 2 values and 1 value is a dollar value this calculator can be used to solve for the other 3 unknow variables.

Gross margin is expressed as a percentageGenerally it is calculated as the selling price of an item less the cost of goods sold e. Is 30 for the year. Using the gross profit margin formula we get.

Notice that when you enter the cost in both of these examples and the desired margin or markup the selling price is going to be different. Just like a margin markup can be depicted as both a dollar amount or a percentage. Given cost and selling price calculate profit margin gross profit and mark up percentage.

The company has net sales of 300000. Cost C Revenue R or selling price. To calculate the Gross Profit Margin percentage divide the price received for the sale by the gross profit and convert the decimals into a percentage.

Number of units purchased. Net profit margin measures the profitability of a company by taking the amount from the gross profit margin and subtracting other operating expenses. Gross margin is the difference between revenue and cost of goods sold COGS divided by revenue.

Multiply by 100 to get the percentage. Calculating markup on your products or services can get a little confusing especially if you are new to business accounting. Production or acquisition costs not including indirect fixed costs like office expenses rent or administrative costs then divided by the same selling.

Heres how these three formulas can be implemented. Also you can use the contribution per unit formula to determine the selling price of each umbrella. Cost x 50 Margin Cost Selling Price Result.

The margin of Safety when percentage is asked budgeted sales units breakeven sales unitsbudgeted sales units 100. Divide the gross profit for a single unit by the cost of that single unit. The difference is gross profit.

Gross Margin Gross Profit Revenue 100. Gross Profit Net Sales Cost of Goods Sold 400000 280000 120000. It is determined by subtracting the cost it takes to produce a good from the total revenue that is made.

The variable cost of each unit is 2 per unit. This means that 15 is the remaining profit that you can use to cover the fixed cost of manufacturing umbrellas. And liquor cost is one of the biggest factors to affect profit margins.

In this method we do. Find out the contribution contribution margin per unit and contribution ratio. The number of units sold was 50000 units.

Gross Profit P Gross Margin. Selling Price 150 40 x 150 Selling Price 150 04 x 150. The markup is simply the difference between the selling price and the cost of goods.

When calculating important values related to sales or margin analysis there are 5 key variables and 3 primary equations. Now the selling price per unit of an umbrella was 20. Here is what the selling price formula would look like in action.

Profit margin is an important term for restaurants and bars.

How To Calculate Your Profit Margin Small Business Finance Business Strategy Small Business Accounting

Excel Formula To Add Percentage Markup Excel Formula Excel Microsoft Excel

Pricing Strategy Template Selling Price Margin Calculator Pricing Calculator Handmade Business Business Planner

Pin On Funny Bone

Etsy Seller Fee Calculator Find Out Your Estimated Etsy Seller Direct Checkout And Paypal Fees Now Updated With N Etsy Seller Fees Etsy Advice Etsy Business

How To Calculate Net Profit Margin In Excel Net Profit Excel Calculator

How To Calculate Contribution Margin In 2022 Contribution Margin Accounting Education Accounting And Finance

Techwalla Com How To Calculate Gross Profit Margin Using Excel Techwallacom B07bd92b Resumesample Resumefor Excel Gross Margin Calculator

Use The Online Margin Calculator To Find Out The Selling Price The Cost Or The Margin Percentage Itself How To Find Out Calculator Calculators

Margin Vs Markup Calculator Excel Excel Calculator Excel Templates

Profit Improvement Calculator Plan Projections How To Plan Profit Profitable Business

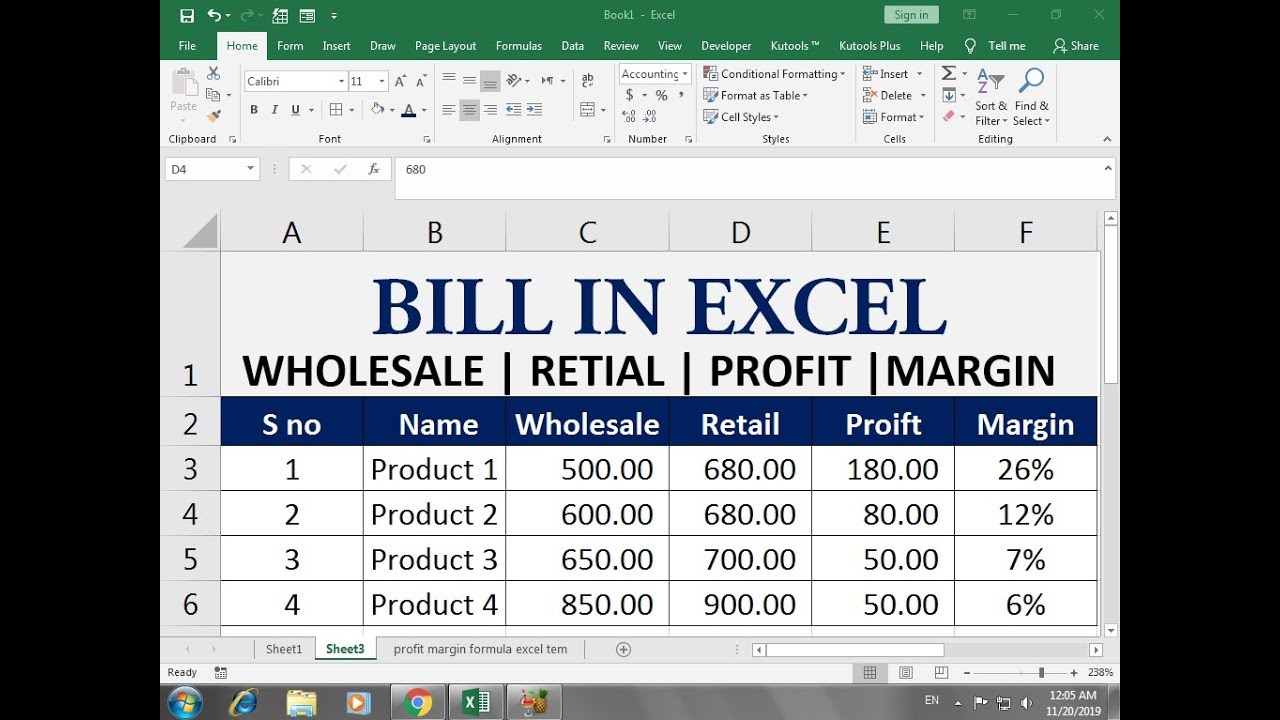

How To Calculate Selling Price From Cost And Margin Calculator Excel Development

Etsy Pricing Calculator Find Out Your Etsy Fees Recommended Pricing And Potential Profit Margins Pricing Calculator Etsy Business Craft Business

How To Price Your Products In 3 Simple Steps

If You Are Looking For A Flexible Way To Price Your Items And Still Add In Different Fees Based On The Dif Etsy Business Plan Pricing Templates Pricing Formula

Gross Margin In A Nutshell Gross Margins Vs Moats Fourweekmba Gross Margin Cost Of Goods Sold Financial Ratio

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel